The Abillity® credit management module allows you to easily configure the desired environment for debtors, invoices, payments, and debtor management through configuration.

Configuration

Leading or following implementation

Abillity® can be deployed as either a leading or following system.

When Abillity® is leading, accounts can be managed directly through the Abillity® user interface. When set as ‘following’, account data can be viewed for reference but not modified.

Users, roles and rights

Abillity® allows you to create custom roles with precise permissions for viewing and modifying data. Users can be assigned multiple roles and specific administration access. All user actions and processes are logged.

The system supports strong passwords with periodic updates and compatibility with common SSO systems.

Multiple administrations

Create multiple business units in Abillity® for different customer groups, separate companies, or other segmentation needs.

Each business unit has its own configuration and segregated data. User and role access can be configured per business unit.

Account types

Configure different account types for clear identification and process segmentation. Define whether accounts are for organisations or consumers, with required fields for personal/address data. Accounts can function as both debtor and creditor without requiring separate entries.

Account structures

Easily define and record account structures to visualize relationships between accounts and support business rules and processes.

Invoice types

Configure different invoice types to differentiate collection processes. Define which types require collection and customize reminder approaches accordingly.

Bank accounts

Seamlessly supports all SEPA banks in the Netherlands and participating countries. Accommodates bank-specific features and multiple bank accounts per business unit.

Bank transaction types

Pre-filled list of customizable bank transaction types to properly channel incoming payment transactions.

Chargeback reasons

Configure follow-up actions for different chargeback reasons, including:

- Automatic re-collection

- Customer notification

- External system signaling

- Or a combination of these actions

If you recognize – based on the reason for the cancellation – that a subsequent direct debit will fail anyway, Abillity® can automatically close the direct debit mandate. This prevents unnecessary costs.

Write-off and surcharge types

Define various write-off and surcharge types for different scenarios, ensuring proper financial accounting allocation.

Block templates

Configure block templates for:

- Collection

- Payment

- Matching

- Reminders

Apply filters to control template availability for specific debtors/invoices.

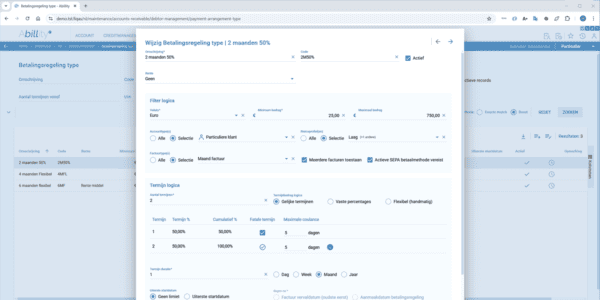

Payment arrangement templates

Define payment arrangement templates with:

- Number and duration of terms

- Fixed amounts or percentages

- Due dates and grace periods

- Debtor/invoice-specific filters

- Optional approval workflows

- Interest calculation capabilities

Want more information?

Are you curious whether our platform is suitable for your organisation?

We’d love to have a conversation with you!