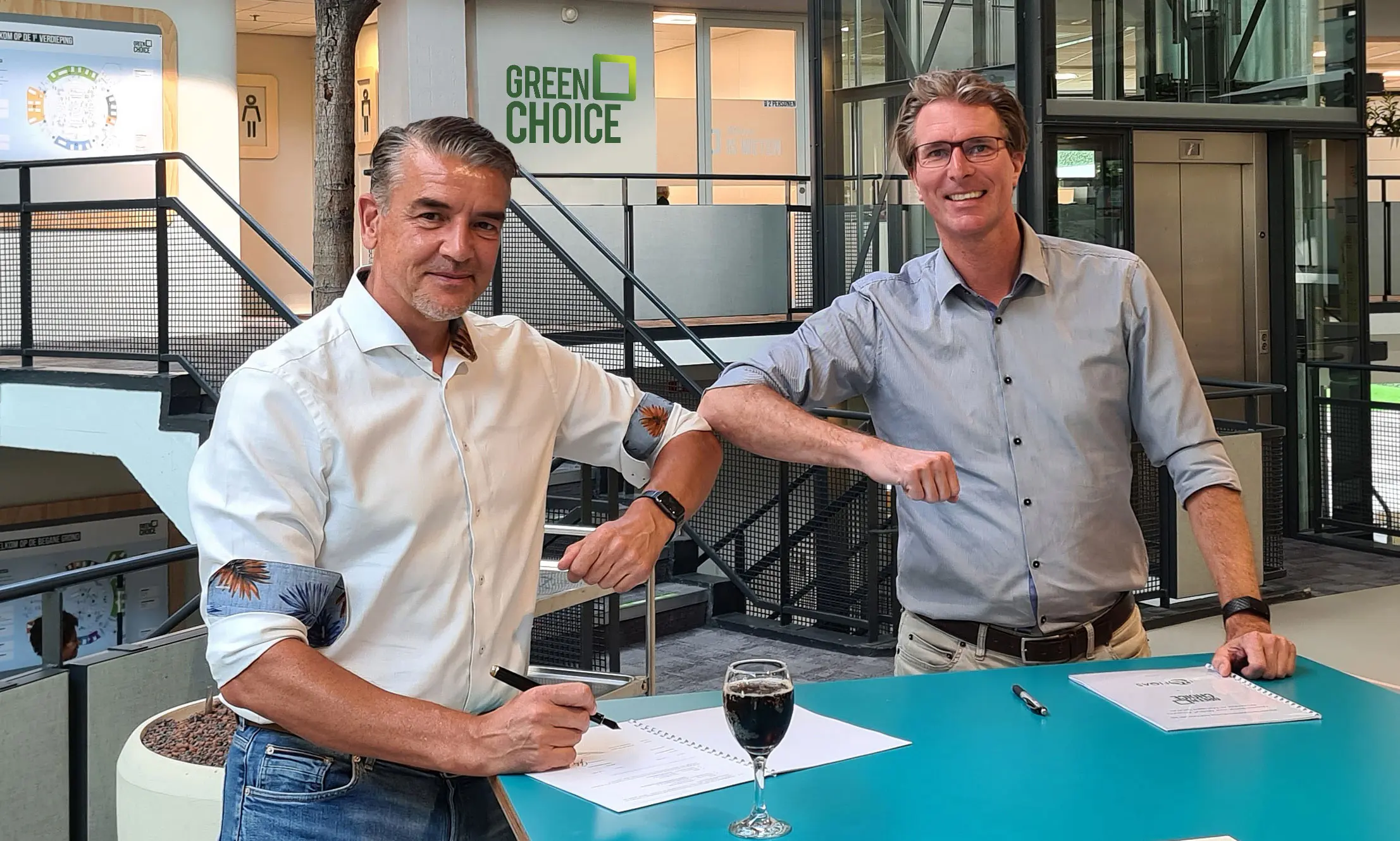

FIQAS Software will manage credit management for sustainable energy provider Greenchoice via a managed service based on its proprietary Abillity® software.

Optimizing the Order-to-Cash Cycle

FIQAS’ solution represents a significant step for Greenchoice in optimizing its order-to-cash cycle, allowing the company to enhance service quality while reducing costs. Leveraging their expertise in debt management and managed services, FIQAS will address the complexities of the energy market.

Commitment to Sustainability

Operating under the ethos of ‘always green,’ Greenchoice supplies green electricity sourced from Dutch soil and compensates gas emissions for both residential and commercial customers. The company demands higher standards for its order-to-cash cycle, including variable collection moments, flexible credit management based on customer profiles or segments, and customized solutions for customers with debts. Moreover, automating communication with external partners like collection agencies and Schuldenknooppunt is essential. To meet these demands, Greenchoice decided to migrate a segment of this process—credit management—from its current customer management system to FIQAS’ solution

Total Control over Payment Processing

With Abillity®, FIQAS offers a seamless standard solution integrated with Greenchoice’s CRM and financial systems without substantial adjustments. The solution supports the entire process from invoices or payment requests originating from Greenchoice’s system to handling outstanding debts.

FIQAS’ solution grants Greenchoice complete control over payment processing and reminder procedures, ensuring a smooth execution and progress tracking. Experienced billing managers from FIQAS conduct daily checks and monitor automated credit management processes, providing Greenchoice with comprehensive support in credit management.

Integration with ‘My Greenchoice’ Platform

The FIQAS solution will undergo implementation at Greenchoice in the coming months while the customer management system remains the foundation. This system provides input for FIQAS’ software and serves as the destination for the FIQAS solution’s output. System integration will also include links to the ‘My Greenchoice’ platform and the financial system. The integration is expected to conclude in November, ready for initial customer migrations, with full operational deployment anticipated early next year.

Wouter Joosten, Credit Manager Greenchoice

“To effectively collect outstanding monthly amounts, we employ a nuanced approach to credit management. FIQAS’ software offers us the flexibility to optimize critical processes, catering to the needs of both our customers and internal stakeholders. Furthermore, the FIQAS solution will eliminate several less efficient or minimally automated steps developed over the years, ensuring timely and accurate data for our financial administration.”

Rob Geleijn, Algemeen CEO FIQAS

“We provide Greenchoice with an optimally integrated and proven ‘best of breed’ debt management solution, already used by many other clients. It can be implemented relatively swiftly and with minimal alterations, aligning precisely with Greenchoice’s requirements. This contract allows us to combine our expertise in pricing, billing, and collection with debt management and managed services.”